US tariffs could severely impact Japanese suppliers of low value added/basic car parts, as OEMs could replace their products with tariff-free items.

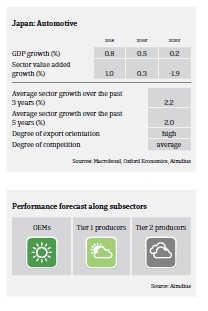

- The business performance and credit risk situation in the Japanese automotive industry remains benign. Profitability in the sector is good with a stable outlook. Due to the robust business performance banks are generally willing to provide loans with good financing conditions, supported by low interest rates.

- While Japanese automotive manufacturers active in the US are affected by the import tariffs on steel and aluminium imposed since June 2017, the impact on profitability has been limited so far. And given the financial strength of the manufacturers, they are able to cope with higher commodity prices in the medium-term.

- The average payment duration in the Japanese automotive industry is around 30 days for car retailers, 30-60 days for manufacturers and 60-90 days for wholesalers. Payment behaviour in this sector has been very good over the past two years. The number of non-payments and insolvency cases is very low, and it is expected that there will be no deterioration in the coming months, given that the business environment remains stable.

- However, potential US import tariffs on Japanese cars and car parts remain a major downside risk for the industry, as the US market contributes a significant share of revenues for most major OEMs and many Tier 1 and Tier 2 suppliers. US tariffs could severely impact Japanese suppliers of low value added/basic car parts, as OEMs could replace their products with tariff-free items.

- Although the Japanese government is promoting the use of electric vehicles (EV), any transition away from gas cars is expected to be very gradual. The production volume of EVs by Japanese OEMs is still relatively low. Given this gradual shift, the impact on suppliers to adapt (e.g. by investing more in R&D and shifting away from producing parts for combustion engines) will be limited over the coming 2-3 years. Therefore no market shake-up like in the EU is expected.

- Due to the generally positive indicators we currently assess the credit risk and business performance of the automotive sector as “Good”, and our underwriting stance continues to be very open for large manufacturers and Tier 1 suppliers.

- We have adopted a neutral approach for smaller Tier 2 businesses, which often produce low-tech/substitutable products, have weaker financials, and are therefore more vulnerable to sudden changes in market sentiment. We closely observe any effects that an escalation of trade disputes could have on the sales and profit performance of manufacturers.

相关资料

1.19MB PDF