Subdued demand, but deterioration of profitability should remain limited

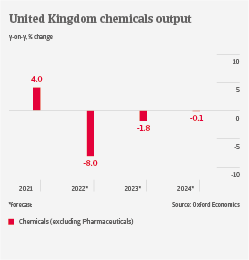

We forecast UK chemicals output to decrease by 8% in 2022 and about 2% in 2023, because high energy and input prices are weighing on the industry. High inflation and rising interest rates continues to erode household purchasing power, while GDP will contract in 2023. This all leads to lower demand for products such as soaps and detergents or cars, with automotive being a key buyer sector for chemicals. A slowdown in construction activity will additionally curb demand from the paints and coatings segment.

To cope with high energy prices, chemical manufacturers are sometimes required to renegotiate price contracts with their customers. This is to try to ensure they remain sustainable in the medium to long-term, but has led to several plant closures. While some businesses are able to pass on costs to their buyers, those with fixed contracts are susceptible to financial pressure. In order to support businesses, the British government announced an energy price cap for six months until April 2023.

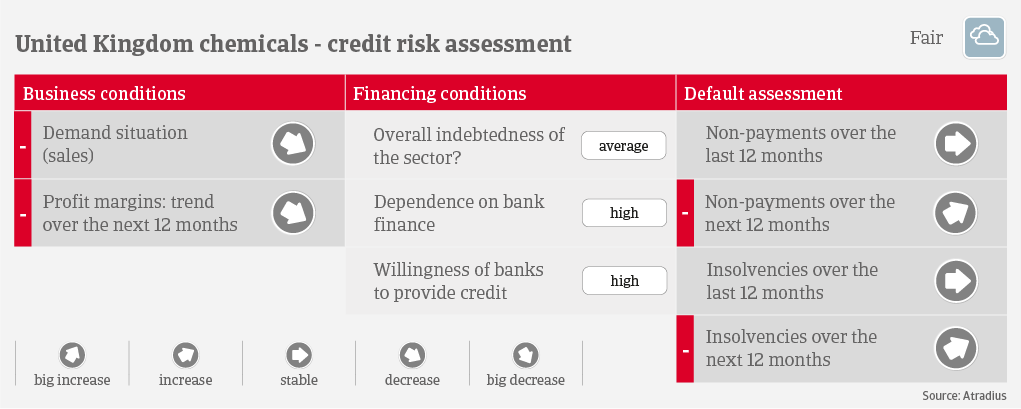

In the chemicals sector, gearing mainly relates to working capital requirements driven by prices/seasonality. Businesses generally do not have to meet large interest and capital repayments. This provides some scope to manage the current deterioration in profitability. Banks are still willing to provide loans to the industry.

Payments in the British chemicals sector take 60-90 days on average, and the number of payment delays and insolvencies in the industry has been low during the past 18 months. As high energy and commodity costs continue to burden businesses, we expect insolvencies to increase by about 5% in 2023. We assess the credit risk situation of the UK chemicals sector as “Fair” across most segments, because the deterioration of profitability should remain limited, banks are still willing to provide loans, and the expected increase in business failures will not be overly high.

In the mid and long-term, the impact of Brexit could weigh on chemical industry prospects, causing a shortage of skilled workforce and an increased regulatory burden. While the United Kingdom has set up its own regulatory system for the chemicals sector (UK REACH) since January 2021, compliance costs for exports to the EU are expected to increase.

Related documents

2.03MB PDF