Freeze of EU funds severely affects civil engineering

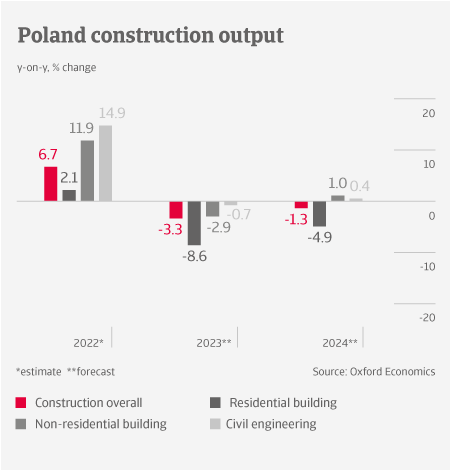

After growing 6.7% last year, Polish construction output is forecast to contract by more than 3% in 2023. Due to double-digit inflation rates the central bank has sharply increased interest rates, to 6.75% since September 2022. This had a negative impact on financing existing and new building projects. It also led to a major decline in mortgage loans, hitting residential construction in particular.

Construction output Poland

Many infrastructure projects are dependent on EU funding. However, the ongoing freeze of EUR 36 billion from the Next Generation EU fund (due to a dispute between the EU and Poland about rule-of-law issues) severely affects civil engineering activity. Commercial construction is affected by higher loan costs and the economic slowdown. That said, last year we saw a robust increase in industrial and warehouse construction.

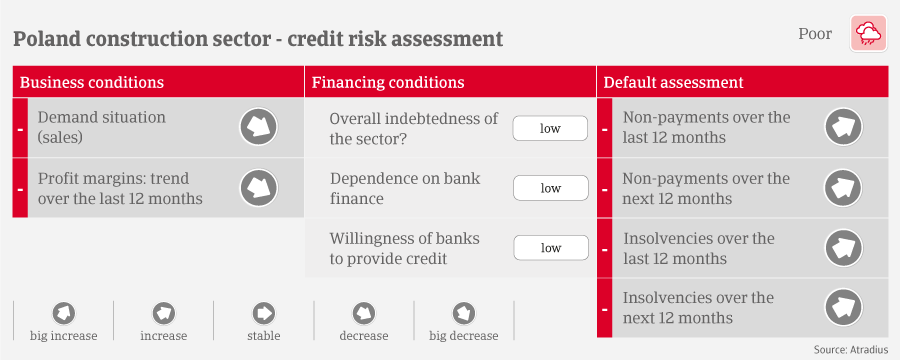

Alongside lower demand, the construction sector suffers from high energy costs. After a sharp increase in 2021, prices for building materials have started to decrease in H2 of 2022, but remain elevated. Passing on higher input prices to customers is very difficult in a market characterised by fierce competition and a marked activity slowdown. Profit margins of construction businesses increased in 2020 and H1 of 2021, but have decreased since then, and we expect this downturn to continue in 2023.

Payments in the Polish construction industry take 83 days on average. The sector is prone to payment delays, as there are many disputes related to quality and scope of work. Overdue payments of up to 30 days are common. Payment delays suffered by a company are usually passed on to peers along the value chain. Since H2 of 2022, we have observed a significant increase in non-payment notifications, and we expect this adverse trend to continue in 2023. Insolvencies are following the same trend, and we expect construction business failures to increase by more than 30% in 2023, due to the strained liquidity situation of many companies, coupled with decreasing demand. Most vulnerable are companies that have a low level of diversification in their work portfolio, and that are focused on infrastructure and/or residential construction.

Given the deteriorated credit risk situation and subdued business performance outlook for this year, our sector assessment remains “Poor” for the time being.

Related documents

1.33MB PDF