Digital transformation is a major growth driver

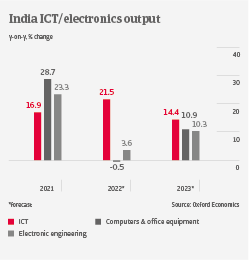

The Indian ICT sector has performed very well during the past two years, and demand is expected to increase further in the coming years. In the B2B segment, many Indian companies are focusing on upgrading their systems and on digital transformation. The same focus accounts for government ICT investments. Computer & office equipment producers, as well as service companies, benefit most from this demand surge. In the B2C segment, demand was robust during the pandemic-related lockdowns, due to a sharp increase in remote working and e-learning. However, demand could taper as the situation returns to normal and inflationary pressures restrict household purchasing power. End-prices for ICT products have also increased. This should affect short-term demand of smart home devices, wearable devices and new TV sets. That said, the Indian consumer electronics market is forecast to grow annually by 5.8% in the 2022-2026 period, supported by demographic developments.

The telecommunication segment benefits from higher investments in 5G infrastructure and increasing mobile phone penetration. However, market competition is fierce due to a lack of product differentiation, while the ongoing chip shortage hampers project completions.

With offices and educational institutes opening again, the business prospects of ICT wholesalers and retailers are not as benign as during the pandemic. This segment mainly consists of small businesses with a low financial risk profile (stretched liquidity, low margins, fierce market competition).

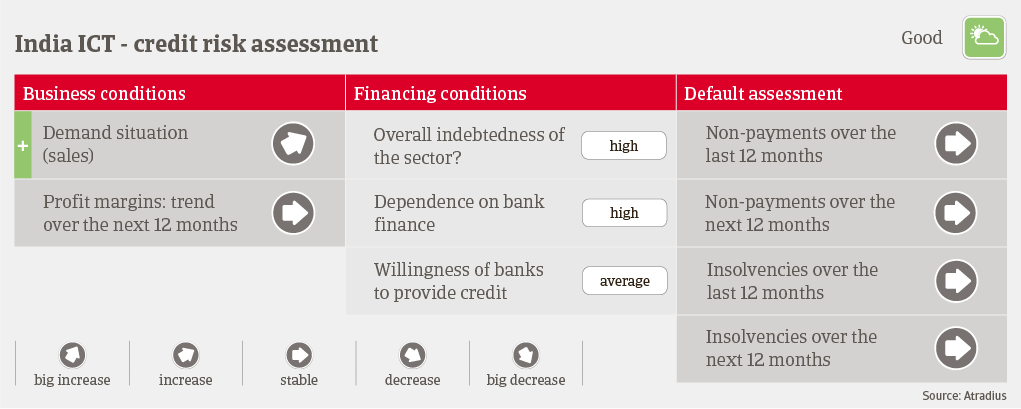

ICT production and sales remain impacted by semiconductor shortage, which we expect to last into 2023. Businesses are currently pre-ordering material in bulk and piling up inventory in anticipation of demand. This has led to higher working capital requirements. However, as cost increases are passed on to end-consumers, we expect profit margins to remain stable in the coming months.

Payments in take between 60 and 90 days on average. Payment behavior in the ICT industry has been good during the past two years, with a low level of payment delays. A main reason has been the persistent raw material and chip shortage, enabling sellers to demand payments in advance and setting strict payments terms. Not abiding, and paying late, could have exposed buyers to the risk of not being able to source chips and commodities. We expect no increase in payment delays during the coming twelve months, with the exception of large government/smart city projects, which are traditionally more prone to delays. The number of business failures should remain low in H2 of 2022 and H1 of 2023, and our underwriting stance is open across all subsectors. However, given that many smaller businesses are highly geared and have a low capital base, we scrutinize carefully financial strength of individual buyers.

Related documents

986KB PDF