The domestic ICT market remains affected by stiff competition, declining margins, low entry barriers, lack of bank support and slow economic growth.

- The ICT value chain in the UAE encompasses vendors, distributors, power retailers, resellers and other small retailers. There is no manufacturing. Most of the vendors and distributors are in Dubai’s free trade zones and redistribute to the wider Middle East. Domestic demand is driven by expatriats, tourists, shopping festivals and regular speciality electronic retail events.

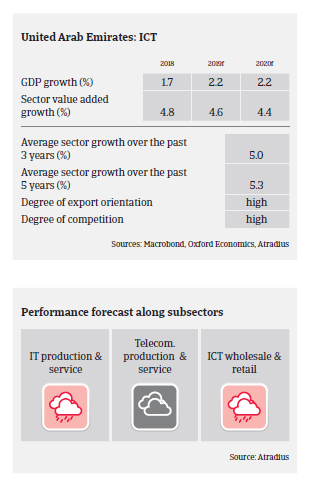

- Oil price volatility continues to put downward pressure on the economy and discretionary spending, including in the IT segment. Sales of consumer electronic devices, computer hardware, audio visuals and handsets in the UAE are expected to reach USD 9.9 billion in 2019, a very modest annual increase.

- The UAE’s ICT market remains affected by stiff competition, low and declining margins, low entry barriers, reluctance of banks to support, reliance on tourist inflows (which currently show sluggish growth rates compared to the past) and slow economic growth. The imposition of new taxation and customs duties on certain electronic related products in India and persistent political instability in the Middle East has negatively impacted the overall demand for ICT products.

- Payment delays and protracted defaults continue to remain high due to cash flow problems of many ICT businesses, aggravated by the lack of support from banks in the form of reduced or cautious lending. In H2 of 2019 insolvencies are expected to level off at a high level, while paymend delays are expected to increase further.

- We continue with our prudent and selective approach on buyers in the ICT sector in UAE, especially for the wholesalers and retail segment, which has severely suffered from lower demand, high competition and deteriorated margins.

- Special attention is also given to distributors and resellers exporting to high political risk countries in the Middle East and Africa. In the telecommunication sector we maintain a prudent approach with smaller players. In any case, the availibility of the latest audited financials and updated trading experience are key requirements for business reviews in the ICT sector.

Related documents

1.13MB PDF