Higher credit risk for the meat and food services segments

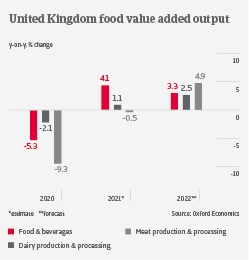

UK food & beverages output is forecast to grow by more than 3% in 2022, after increasing 4.1% in 2021 and a 5.3% contraction in 2020. Retailers have largely benefitted from increased demand over the past two years.

However, in particular for food producers and processors challenges are mounting, due to rising input prices, the ongoing pandemic and Brexit. Across all segments, sharply increased costs for commodities, energy, fertilisers, transportation and packaging have led to higher input prices along the value chain. Sanitation protocols and absenteeism have additionally added to cost pressure. While the EU-UK non-tariff agreement is largely positive, there are additional costs associated with customs declaration and local content audits. Lack of skilled workers from the EU are adding to the serious issue of labour shortage in food production/processing, and inevitable salary increases in order to retain or attract staff are causing additional cost pressure.

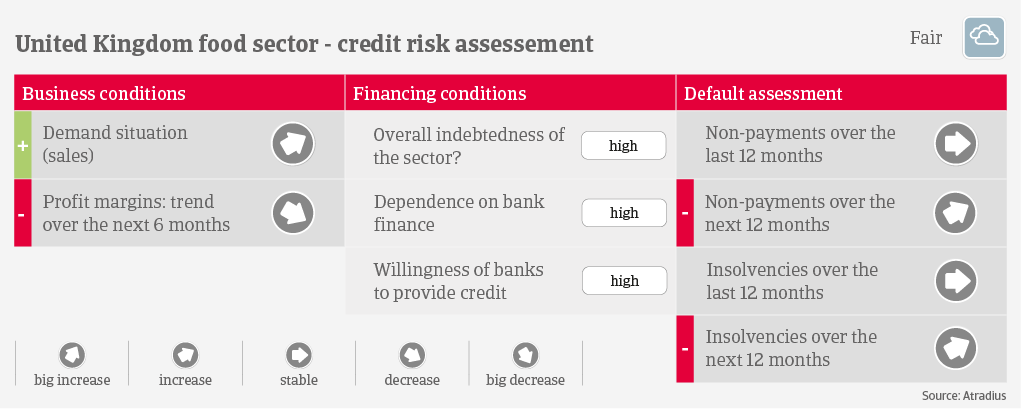

While food producers and processors try to negotiate higher sales prices with their wholesalers and retailers, passing on all input price increases will be difficult. We expect margins of many businesses to deteriorate, forcing them to upgrade their cost management and to improve efficiency. However, despite such measures we expect that the credit risk quality of many businesses will suffer in the coming months.

Payments in the sector take about 45-60 days on average. The amount of payment delays and business failures has been artificially low in 2020 and 2021, due to massive stimulus measures and bankruptcy moratoriums. However, with the expiry of fiscal support and input cost inflation hurting profits and cash generation, liquidity issues will increase. We expect an insolvency increase of about 20% in 2022 compared to 2019, back to normal levels. Mainly exposed to business failures are the meat and food services segments.

Meat producers and processors suffer in particular from high input costs and lack of skilled labour. Many food service businesses have made significant borrowings, and the segment suffered severely from deteriorated hospitality demand during the lockdowns. That said, the dairy and fruits and vegetables segments perform quite well despite some cost pressure.

相关资料

915.0KB PDF