Ongoing production delays could impact margins of automotive suppliers

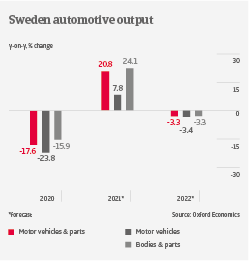

After contracting 23.8% in 2020, Swedish motor vehicles output is forecast to rebound by only 8% in 2021. Original Equipment Manufacturers (OEMs) have been forced to curb production due to a shortage of semiconductors and other components. After a sharp increase in H1 of 2021, new car registrations declined 21% year-on-year in September, due a supply shortage of new cars.

OEMs have started to prioritise production of higher-margin models in order to sustain profitability. While margins of OEMs and suppliers are not expected to decrease sharply in Q4 of 2021, ongoing production delays in 2022 would subsequently squeeze the margins of suppliers. Another issue is exchange rate volatility, as the sector is highly export-dependent. Costs are usually incurred in Swedish krona, and the recent appreciation against the Euro could hurt international competitiveness.

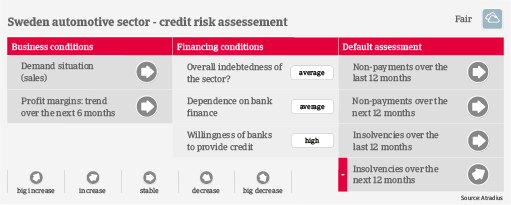

Swedish automotive businesses are not highly leveraged, while the current low interest rate environment facilitates debt servicing. Depending on the level in the supply chain, payment duration in the automotive sector ranges from 30 to 90 days. Automotive insolvencies are expected to increase by about 10% in the coming twelve months, as fiscal support will be phased out. The increase will mainly affect smaller suppliers that were ‘saved’ from bankruptcy in 2020 and in H1 of 2021 by corona-related government support. In addition, smaller businesses could face liquidity issues in Q2 of 2022, when payment of deferred taxes will become due. Downside risks for the insolvency development in 2022 are a prolonged shortage of materials like semiconductors and ongoing supply chain bottlenecks, as well as another surge of the pandemic. Despite the downside risks our sector outlook remains “Fair” for the time being.

As the majority of Swedish suppliers is active in the commercial vehicle segment (trucks and buses), the pressure to swiftly convert to e-mobility is lower than in the passenger cars segment, providing those suppliers with more time to adapt and to transform their businesses.