Only a modest increase in insolvencies expected

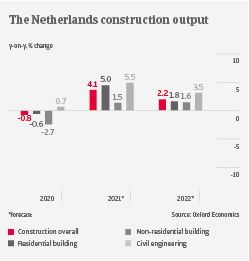

After a modest 0.8% contraction in 2020, Dutch construction output is forecast to grow by about 4% in 2021, and more than 2% in 2022. The rebound is mainly driven by residential construction and civil engineering. In the Netherlands, housing demand will remain high in the coming years, while infrastructure needs to be maintained and upgraded. However, non-residential construction rebound recovery remains muted for the time being, due to an ongoing lack of commercial construction demand.

Dutch construction remains impacted by environmental issues, i.e. nitrogen reduction and tighter rules regarding per- and polyfluoroalkyl substances (PFAS) in the soil. They have resulted in many building project delays and postponement of building permits even before the pandemic. The current shortage of building materials has led to additional project delays. Tenders are affected by the reluctance to bid, as builders are afraid of not being able to pass higher construction material prices on to customers. There is an urgent need for construction businesses to find according agreements with developers (e.g. escalation clauses).

The Dutch construction market is mature, characterized by low entry barriers and competition driven by price. At about 3%, profit margins have been very low for several years. Increasing prices for construction materials and higher wages will most probably have a negative impact on profit margins in the coming months.

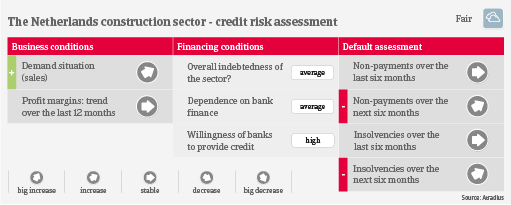

Payments in the construction industry normally take about 45 - 60 days. Payment experience has been good over the past two years, as the sector remained relatively stable during the pandemic. However, tighter environmental regulations and surging materials prices will most probably lead to increasing payment delays and insolvencies in the coming six months. Business failures are expected to increase by about 5%, albeit from a very low level. Due to the continued demand, our sector assessment remains “Fair” for the time being.

相关资料

1.06MB PDF