Higher costs, reduced orders, price pressure and changes in the type of products demanded could put the finances of many smaller suppliers under stress.

- Both production and new orders of cars have significantly slowed down since Q4 of 2018, and the outlook remains subdued for the coming 12 months, mainly due to lower demand from the EU and increased market uncertainty (especially over potential trade disputes and a hard Brexit).

- Together with rising energy and labour costs the flat demand situation has increased pressure on margins of Czech automotive businesses - just at a time when more investments are needed to adapt the product portfolio (shift to e-mobility) and to increase automation (increasing lack of labour force).

- For the time being, we do not expect a significant increase in payment delays and insolvencies in the industry. However, a small increase in business failures of about 2% in the coming 12 months seems probable, as small suppliers at the bottom of the value chain will experience increasing cash-flow problems due to deteriorating turnover and margins, while costs for external financing and labour are growing.

- We expect that in the coming 2-3 years price pressure will be increasingly passed - top down – through the value chain, mainly affecting Tier 2 businesses. Higher costs, reduced orders, price pressure and changes in the type of products demanded could put the finances of many smaller suppliers under stress. While a sharp insolvency increase is not expected in the mid-term, the very low levels of automotive business failures will be a thing of the past.

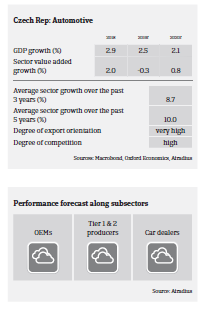

- Currently a sharp deterioration of the risk environment is not expected, rather a step-by-step adaption to the changing market conditions, with increasing focus on production of higher value added goods. The Czech automotive sector has seen robust growth in production capacities over the last ten years, with significant investments and good profits. Many players are part of international groups, and while increasing, local labor costs are still below Western European levels.

- For the time being our underwriting stance remains generally neutral, but given the more clouded outlook, our risk appetite has become more restrictive than in 2018. Should the pressure to shift towards electric cars accelerate and/or US trade tariffs be imposed, the credit risk situation in the sector would definitely increase.

相关资料

1.19MB PDF