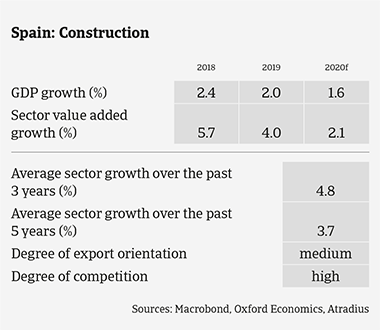

Over the past years construction investment and valued added grew at a faster rate than GDP, benefitting from robust economic growth in Spain, increased foreign investment and low interest rates.

However, it must be said that the construction rebound came from a very low level, following years of severe recession.

In 2020, construction value added growth is expected to slow down, in line with lower economic expansion, and this deceleration is expected to continue in 2021. Building activity is reaching a more mature phase, with mortgage grants, sales prices and housing construction losing momentum.

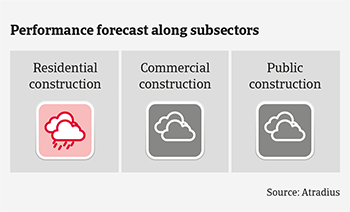

The overall situation of the residential construction market remains weak. Profit margins remain very tight despite a modest rebound in 2019 (in 2018 margins were affected by higher labour costs). Input costs remain elevated and the level of competition is high. Uncertainties in the housing market related to sales prices and lower demand remain.

Non-residential building is not affected by rising input cost as much as residential construction is, but more modest profit returns will have a dampening effect on investments made by real estate investment trusts, funds, etc. This will lead to more moderate growth.

It is expected that the new government will moderately increase public construction and civil engineering investment. However, uncertainties remain over political stability and budget issues (necessary deficit reduction measures)

In the construction material subsector profit margins remain affected by increased energy costs and raw material prices. Moreover, the high average payment period of customers (mainly larger constructor companies) affects the working capital management of many small companies. Overseas markets are impacted by more uncertainty due to tariff disputes and Brexit.

Across all subsectors many Spanish construction businesses are highly leveraged and depend on external financing, while financing demand continues to grow due to higher labour and commodity costs. Smaller companies often have limited capacity to access to new financing.

The average payment duration in the construction industry is quite high at 100 days. Compared to other industries the level of protacted payments and insolvencies remains high. Both non-payment notifications and insolvencies increased in H2 of 2019, but are expected to level off in 2020.

Our underwriting stance for the residential construction segment continues to be restrictive, while remaining neutral for the commercial construction, public construction and construction materials subsectors. It is necessary to contact buyers for updated financial information. Performance outlooks as well as potential changes in the current financing conditions are closely monitored.

Market Monitor Construction Spain 2020 sector growth

Market Monitor Construction Spain 2020 performance forecast

相关资料

1.42MB PDF