What drives Swiss companies' mood of caution in B2B trade?

Cautious mood prevails as companies strive to preserve liquidity

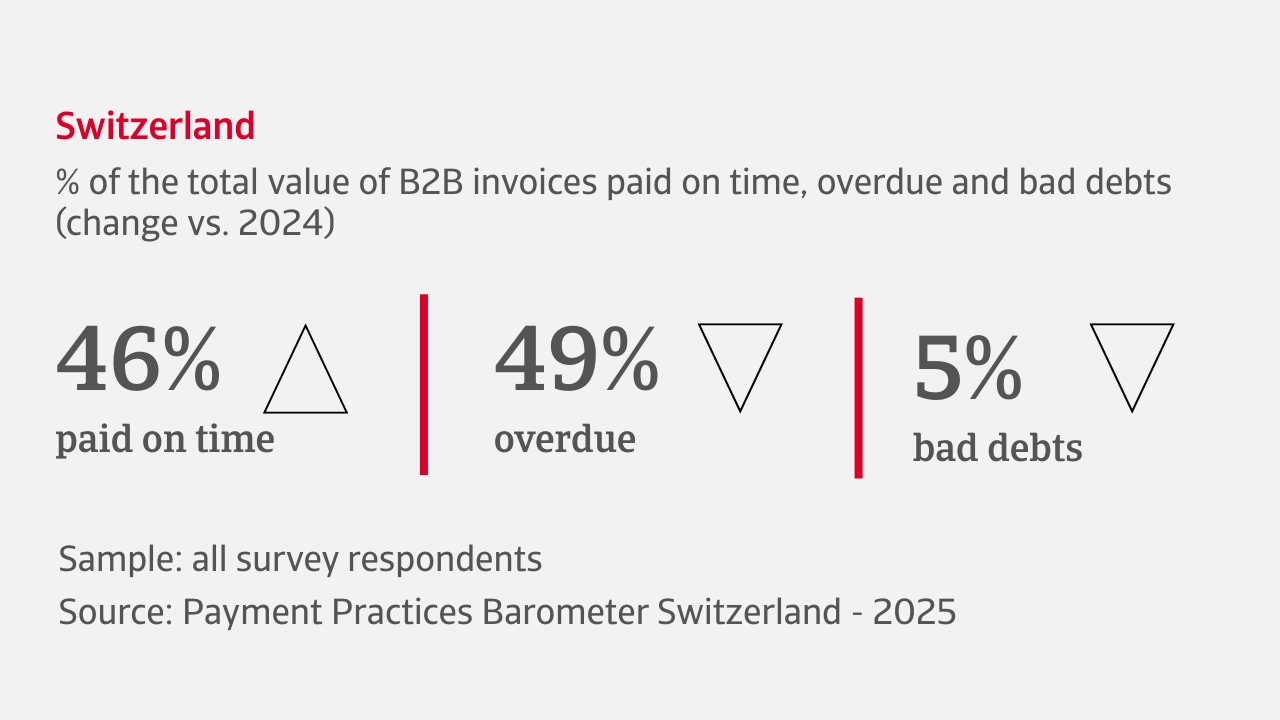

An average 51% of sales to B2B customers are currently being transacted on credit by Swiss companies, highlighting a consistent reliance on trade credit. The majority of businesses report no change in credit policy, and payment terms also remain largely unchanged, most falling between 30 to 60 days from invoicing. When changes are made, Swiss companies tend to extend payment durations, indicating a desire to prioritize customer retention and ongoing trade flow, even at the cost of longer cash conversion cycles.

.2025-09-25-13-06-38.png)

Days Sales Outstanding (DSO) has shown some fluctuations but no significant improvement, limiting the ability to free up cash from receivables. Compounding the issue, inventory turnover has remained slow or stagnant for most businesses, further tying up liquidity in stock that could otherwise be used for operational needs. While most companies continue to pay suppliers on schedule, some have started delaying payments as a liquidity-preserving measure. To bridge liquidity gaps, most Swiss companies rely on supplier credit and invoice financing, which offer immediate relief but can affect longer-term financial flexibility.

What are the concerns for Swiss businesses in the coming months?

Insolvency risk expected to rise amid increasing economic uncertainty

A growing number of companies in Switzerland tell us they anticipate facing financial headwinds during the coming months. 55% of businesses expect insolvency risks among B2B customers to increase, reflecting heightened concern about economic uncertainty and a probable tightening of liquidity conditions. The remaining companies expect no major changes, suggesting a cautiously stable outlook for some sectors, although optimism nevertheless remains guarded.

Our survey finds that in the crucial area of working capital management most Swiss businesses foresee no significant changes in Days Sales Outstanding (DSO). This indicates an expectation of continued consistency in customer payment behaviour, which aligns with previous trends where payment discipline has remained steady, albeit with ongoing delays. Similarly, most companies predict no significant shifts in inventory turnover. Among those expecting changes, more anticipate faster inventory movement rather than further stock build-up, a sign of cautious optimism about demand and operational efficiency.

Swiss companies are worried about three main challenges: the tightening of regulations and compliance requirements, the fluctuating costs of production inputs impacting operations, and the growing pressure to adopt sustainability practices due to environmental concerns.

Industry insights

Chemicals industry

52% of B2B sales are currently being conducted on credit, with most companies reporting steady credit offerings. Payment terms follow the same trend, reflecting a broader strategy to support customer relationships during uncertain times. However, payment risks remain a challenge. 51% of B2B invoices are overdue, and 6% result in bad debts. Delayed payments are due to cash flow challenges, strained supply chains, or extended credit cycles. Payment behaviour has remained consistent, which is reflected in stable Days Sales Outstanding (DSO). Improved DSO has helped unlock liquidity for some, though stagnant or rising inventory levels continue to trap working capital.

Key industry figures and charts are provided in the report available for download below on this page.

Construction industry

Construction companies conducted 56% of their B2B sales on credit in recent months, and most businesses reported no change in credit offerings. Those who did adjust them were more likely to expand rather than restrict them. Payment terms followed a similar pattern, remaining largely unchanged, with some companies offering longer rather than shorter durations. Although the payment behaviour of B2B customers remained stable, a few companies noted signs of deterioration, pointing to ongoing challenges in customer payment discipline. Our survey found that 42% of B2B invoices are overdue, and 3% have turned into unrecoverable bad debts.

Key industry figures and charts are provided in the report available for download below on this page.

Machinery industry

A cautious approach to trading on credit is highlighted by less than half of B2B sales being transacted on credit in the machinery industry. Most firms reported stable credit offerings, with payment terms largely unchanged. Where adjustments were made, longer payment periods were more common than tightened terms. Despite steady credit policies, 54% of B2B invoices are overdue and 7% have become bad debts, revealing significant payment risk exposure. Delays are primarily due to customer cash flow constraints, extended supply chains, and broader economic pressures. However, most companies noted consistent payment behaviour year-over-year, indicating persistent slow-payment trends rather than a sharp deterioration.

Key industry figures and charts are provided in the report available for download below on this page.

Interested in finding out more?

For a complete overview of the 2025 survey results for Switzerland, download the full report available in the related documents section below.

To explore more on how these insights can strengthen your own credit risk strategy, speak with us at Atradius to see how we can help you stay ahead.

- Companies in Switzerland report ongoing challenges with cash inflows related to B2B trade due to significant impact of delayed payments.

- This requires effective cash flow management to bridge liquidity gaps, often relying on supplier credit and invoice financing.

- Expected increase in insolvency risk in the months ahead raises concern over probable tightening of liquidity conditions.

- Increasing production input costs affecting operations and investment decisions along with several other risk factors are expected to affect businesses financial health in the coming months.