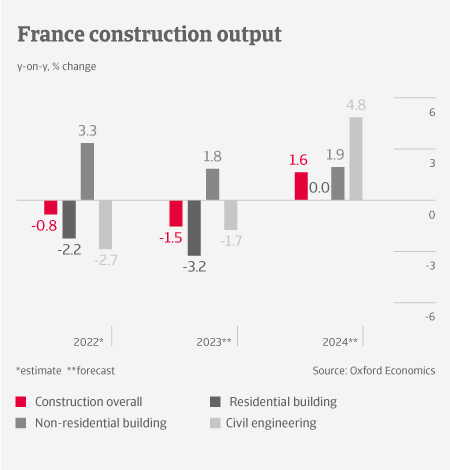

The 2023 outlook for construction activity is subdued, due to low economic growth of 0.1%, elevated inflation and higher interest rates. Increased expenses for construction materials and wages, together with tighter environmental standards, weigh on building costs. Additionally, supply chain issues for some materials still cause construction delays.

The 2023 outlook for construction activity is subdued, due to low economic growth of 0.1%, elevated inflation and higher interest rates. Increased expenses for construction materials and wages, together with tighter environmental standards, weigh on building costs. Additionally, supply chain issues for some materials still cause construction delays.

In the residential construction segment, inflationary pressures and tighter credit conditions severely weigh on building activity. The non-residential market suffers from lower investment in offices and retail spaces, and has not yet recovered to pre-Covid levels. Civil engineering order books for public projects are low, and authorities are slow in adjusting their budgets to higher inflation.

In the residential construction segment, inflationary pressures and tighter credit conditions severely weigh on building activity. The non-residential market suffers from lower investment in offices and retail spaces, and has not yet recovered to pre-Covid levels. Civil engineering order books for public projects are low, and authorities are slow in adjusting their budgets to higher inflation.

Given the difficult market conditions, it comes as no surprise that operating margins started to deteriorate, and this will continue in 2023. High input costs for materials and energy strongly affect builders holding contracts without escalation clauses. These are frequent among public construction builders, but uncommon in the residential construction market, and most real estate developers cannot pass on cost increases to customers. Construction businesses are currently more highly indebted than in the past. Many have started to draw on their short-term credit lines to cope with increased working capital requirements (WCR), but banks are generally reluctant to support their financing needs.

Payments in the construction sector take 64 days on average, compared to 44 days for all other industries. In particular, public bodies and larger construction companies tend to extend payment terms. Due to government support measures, construction insolvencies remained low in 2020 and in 2021.

However, payment delays and insolvencies started to increase in H2 of 2022, back to pre-Covid levels. The main reasons are sharply increased input cost and cash issues due to difficulties in WCR-funding. We expect this deterioration to accelerate in 2023, with construction business failures rising by more than 40% year-on-year, mainly affecting smaller companies. Therefore, we assess the credit risk situation as “Poor” across all main subsectors. Only the renovation work segment focused on energetic renovation remains resilient, because it benefits from government subsidies.