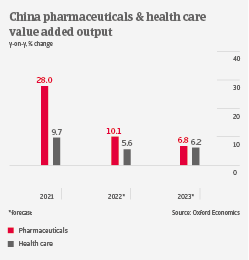

Strong growth is forecast for Chinese pharmaceuticals and health care value added output in 2022 and 2023. In the 2019-2025 period, annual growth of 9.4% is expected. With the Volume-based Procurement (VBP) policy and the National Reimbursement Drug List (NRDL), China has overhauled its health-care system. The main aim is to provide the population with broader access to quality drugs at lower prices. Global and domestic drug producers have to compete to sell their products in bulk to public hospitals. By winning a bulk purchase bid, drug producers have to accept substantial sales price cuts, which at first sight squeeze their profit margins. However, it also provides them with a major share of the Chinese market and high sales volume opportunities. Rising consumer wealth will increase demand for higher quality drugs, while the Chinese population will be rapidly ageing in the coming years.

Currently local producers still focus on generics, and R&D investments are rather low. However, the government emphasizes higher output of patented drugs and more innovations. We expect Chinese producers to increase both R&D investments and product quality in the coming years. To support this, the authorities seek to consolidate the industry and to increase the average size of businesses.

The Chinese pharmaceuticals distribution market has grown steadily over the past couple of years, and a concentration process is ongoing. Competition is fierce in the pharmacies/drugstores segment, and online shops are growing. Profit margins in this subsector are slim, but also stable.

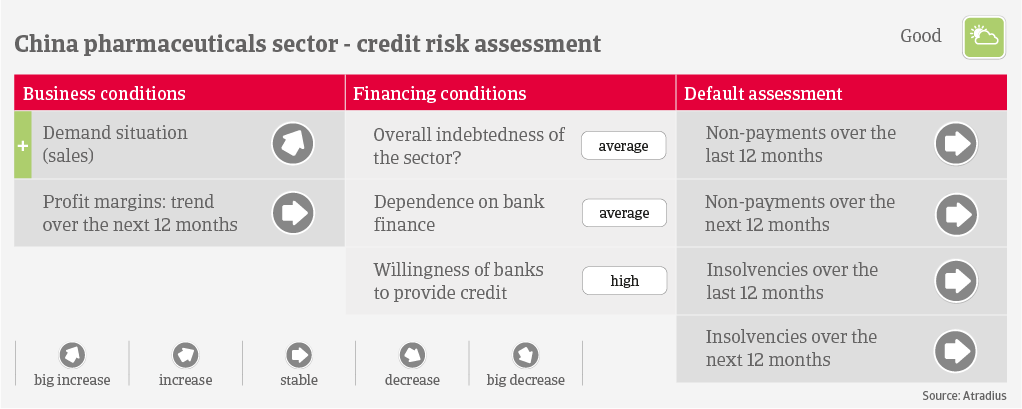

Given the robust growth outlook and government support, banks are willing to provide credit to Chinese pharmaceutical businesses. Payments in the sector take 60-90 days on average, and payment behaviour has been good over the past two years. However, sometimes hospitals protract their payments to distributors. We expect that both payment delays and insolvencies will remain at a low level in 2022. Our underwriting stance for the sector is generally open, in particular for state-owned enterprises.