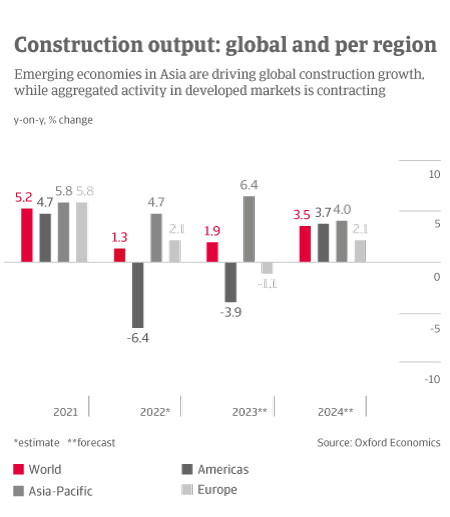

The short-term outlook for the global construction industry is clouded by high levels of uncertainty. With a looming economic recession in major markets due to soaring energy prices and high interest rates, prospects for growth will be muted in 2023.

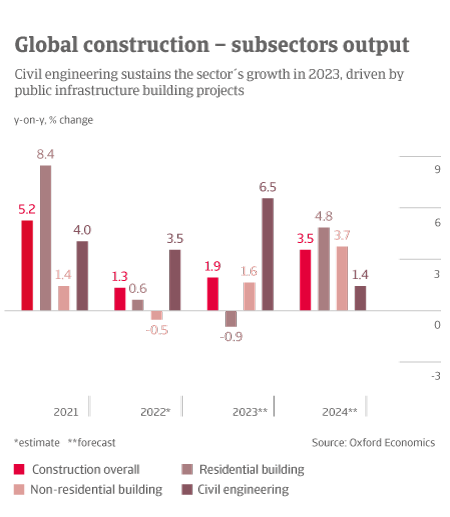

Tighter monetary policy and lower household purchasing power will weigh on demand for new buildings. Aggressive policy tightening by central banks in 2022 has lifted borrowing rates and thereby reduced the demand for building construction work. However, a large backlog of work will help to mitigate somewhat the impact on construction work done during 2023.

Infrastructure investment will drive growth in construction activity. Governments worldwide continue to champion major infrastructure projects to boost their economy’s productive potential and drive the post-Covid economic recovery. This will see civil engineering be the fastest-growing sector in the construction market.

Construction materials supply-side constraints will ease but not dissipate in 2023.

In advanced markets, labour shortage has become a serious issue. Tight labour markets and lack of a skilled workforce increase wage costs for builders in many advanced markets. In Europe this could become a structural problem in the mid-term future.

Construction costs will rebase at a higher level. A correction in the mismatch between supply and demand will ease the pressures driving construction cost growth. However, we do not expect construction costs to fall back to pre-Covid levels.

Work towards a more sustainable future will remain steady. The global push towards a less carbon-intensive future will continue in 2023 and beyond, with further investment in renewable energy generation and other green infrastructure.

Construction and sustainability – challenges and benefits

The construction industry is a major user of natural resources. From energy usage to emissions, it has a huge impact on the environment. According to the International Energy Agency (IEA), the buildings and construction sector accounts for a whopping 36% of worldwide energy use and 40% of CO2 emissions globally. Heavy plants used in construction still lean heavily on fossil fuels. Fabrication and shipping of construction materials have a massive impact on carbon emissions. Global cement manufacturing currently accounts for 8% of CO2 emissions annually, for example, with a rising rates due to ongoing urbanisation around the world.

Amid widespread concern about climate change and the need to cut down emissions, there is increasing pressure on construction firms to reduce their environmental impact. Planning, building materials and construction processes must all change comprehensively. Supply chains have to be rethought, and an understanding of the materials required for a life-cycle approach will become crucial.

Revisions to building regulations are already changing the boundaries for the minimum requirements expected in construction today. This can be challenging, as the example of the Netherlands shows, where construction has been impacted by the need for nitrogen reduction and tighter rules introduced regarding per- and polyfluoroalkyl substances (PFAS) in the soil. This has resulted in building project delays and postponement of building permits during the past few years.

Some benefits already visible

Public construction is currently a strong driver towards more sustainability. National Highways in the UK, for instance, has committed itself to reduce construction-related emissions by 50% until 2030. As this report shows, public initiatives in advanced markets related to sustainability help to sustain the industry during a rather subdued market environment. There are many examples of this trend.

The civil engineering segment in Belgium is supported by public investment in clean energy projects, while the Inflation Reduction Act boosts spending in energy-efficient and sustainable building activities in the United States. The Next Generation EU fund supports large investments in projects with a sustainability aspect, benefiting the Italian and Spanish construction sectors in particular. A widespread phenomenon is increasing demand for renovation/upgrades to improve energy efficiency, and to comply with tighter environmental standards. The residential renovation work segment focused on energetic renovation (heating, ventilation, isolation and renewable energy) benefits from fiscal support/tax deductions e.g. in Belgium, France and Italy.