Reports and whitepapers from our industry experts

Latest news and insights

Latest blogs

Helpful guides at your fingertips

Your questions answered

Examples of high quality credit management processes and practices

Success stories from our diverse range of clients

Load more

Viewing 7 out of 144

Load more

Viewing 7 out of 25

Load more

Viewing 7 out of 12

- What is trade credit insurance?

- What is credit risk?

- Why credit management is important?

- What is business insurance?

- SME Insurance Singapore

- What is debt recovery?

- What is export credit insurance?

- What is political risk insurance?

- How much does credit insurance cost?

- How can I reduce DSO?

- How can I insure my export trade credit?

- How do you know if a business is failing?

- Why do traders take out credit insurance?

Load more

Viewing 7 out of 9

Case study

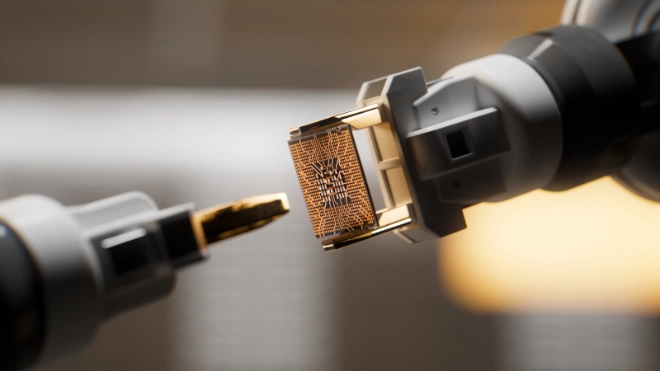

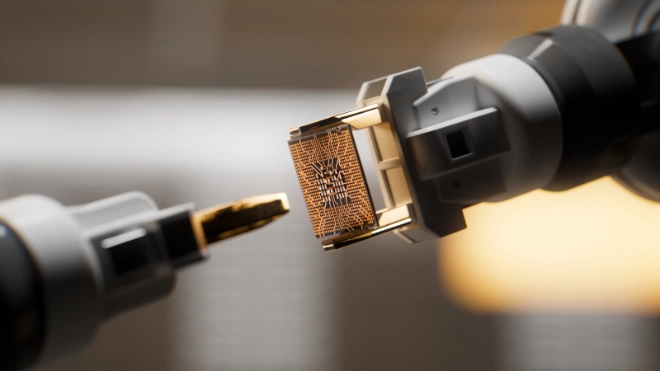

Metalco Inc.: Driving new business with quick communication

Ben Green, President and Owner at Metalco Incorporated in Chicago, Illinois, explains how Atradius Trade Credit Insurance has helped him secure new business confidently.

Explore